Complete Guide to iGaming in Indonesia

Do you plan to run gambling or betting offers in Southeast Asia? Then you should consider such a large iGaming market as Indonesia. Despite legal restrictions, this is a perfect target audience for buying gaming traffic. Today, EVADAV will share all you need to know about the GEO Indonesia: its demographics and locals’ favorite gambling activities, related laws, ways to launch successful advertising campaigns, and making engaging ad creatives.

Who are the Indonesian players?

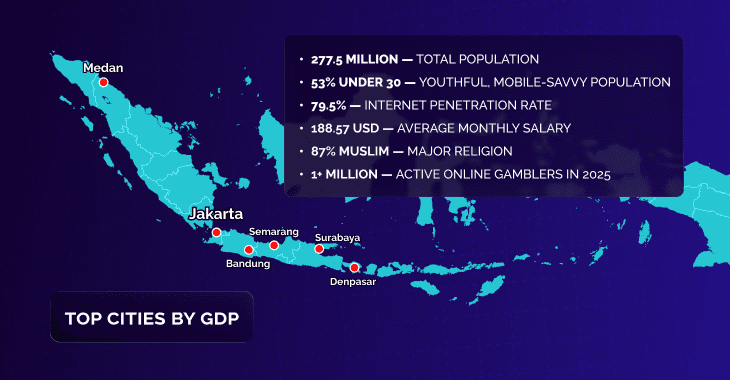

Indonesia is the fourth most populous country in the world, with over 277 million residents as of 2025. More than half of its population is under 30, making it one of the most attractive verticals Indonesia offers for digital marketers, particularly in the gambling and betting verticals.

Here are a few important facts:

-

The average monthly salary is approximately IDR 3,094,818 (~ USD 188.57), with higher wages in urban centers like Jakarta and Surabaya.

-

Indonesia ranks moderately in English proficiency across Asia, with urban areas exhibiting higher fluency levels.

-

Indonesia is a predominantly Muslim (~87%) country, leading to stringent regulations against gambling activities. Despite this, online gambling persists, particularly among lower-income groups.

-

The wealthiest cities, Jakarta, Surabaya, Bandung, Medan, and Semarang, are among the top cities by GDP. Denpasar (Bali) also reports high per capita income and a significant tourism industry, which may influence gambling trends.

Now let’s take a closer look at the local iGaming market and players’ preferences in the GEO Indonesia.

iGaming market overview

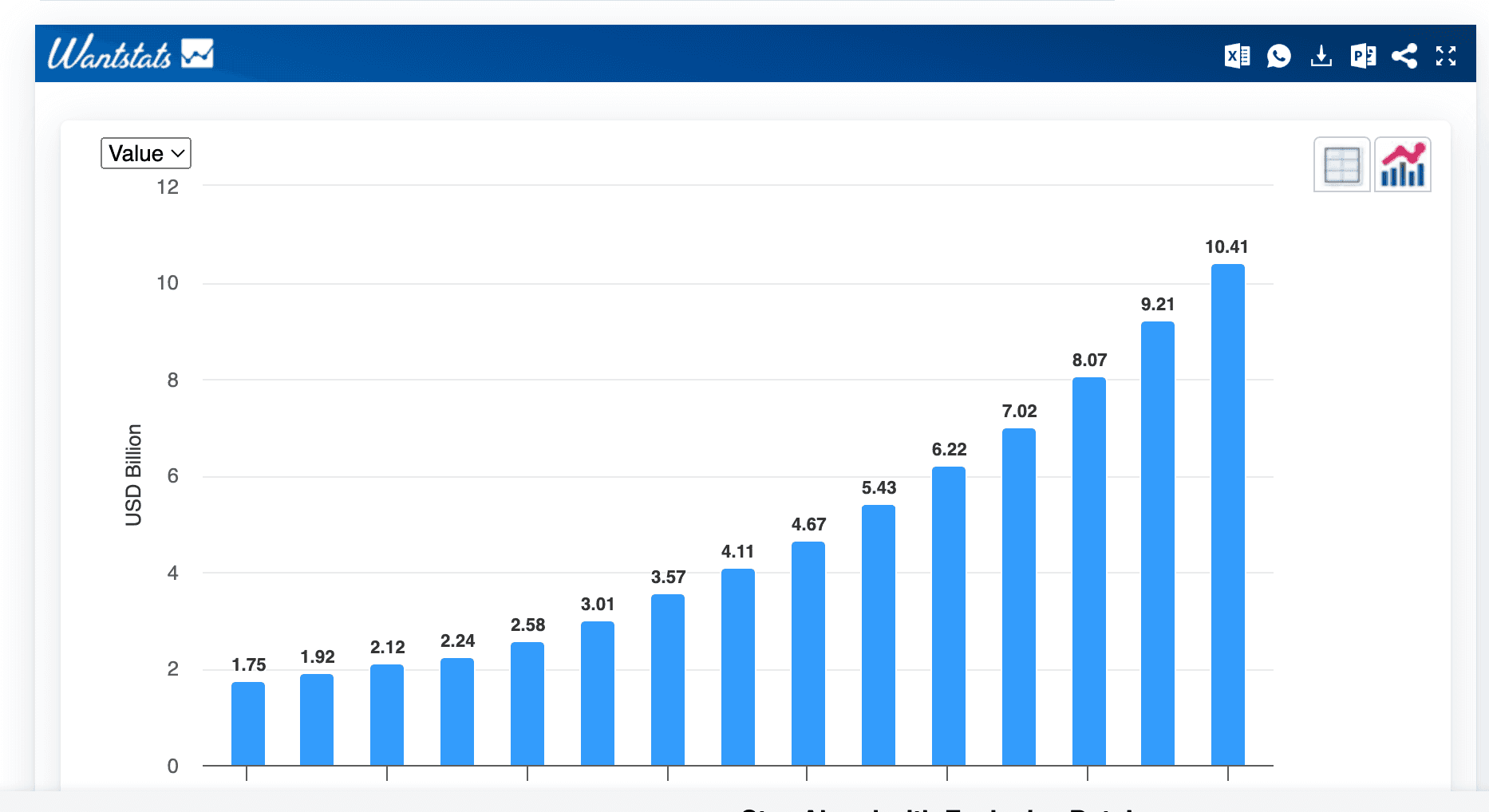

Source: wantstats.com

Indonesia's online gambling market is projected to reach approximately $4.11 billion in 2025, with an expected annual growth rate (CAGR) of 12.5%, leading to a market volume of $7.02 billion by 2029.

The iGaming market growth is driven by the following factors:

-

Mobile-first population. With over 79.5% internet penetration and widespread smartphone adoption, Indonesians are increasingly engaging in mobile gaming and online gambling platforms. Mobile optimization is a must for reaching this audience.

-

Young demographics. A significant portion of Indonesia's population is under 30, tech-savvy, and inclined towards digital entertainment, including online gaming and gambling.

-

Economic factors. The growing middle class and increasing disposable income contribute to higher spending on online entertainment and gambling activities.

-

Technological advancements. The integration of blockchain technology and virtual reality (VR) in online gambling platforms offers immersive experiences, attracting more users.

Regulatory environment for gambling in Indonesia

Gambling and betting are strictly prohibited under Indonesian law. The Ministry of Communication and Information Technology (Kominfo) works in tandem with the Financial Transaction Reports and Analysis Center (PPATK) to monitor and suppress illegal gambling activity, including online platforms. In early 2025 alone, authorities blocked over 43,000 gambling-related websites and digital advertisements, signaling a strong crackdown on digital betting infrastructure. However, there are no mentions of severe punishments for online gamblers in the Internet.

Despite this, the online gambling market in Indonesia continues to grow through offshore operators and proxy services. Local users often access platforms via VPNs or mirror sites. Many Indonesian-facing online casinos and sportsbooks host their infrastructure in jurisdictions like Curacao, the Philippines, or Malta to bypass local restrictions.

These sites typically offer Indonesian language support, local payment gateways (like e-wallets or crypto), and culturally familiar games (e.g., slot gacor, domino QQ) to cater to the local audience while maintaining a low profile. Local players are also drawn to platforms offering "soft betting": prize-based quizzes or luck-based games that operate in regulatory gray zones.

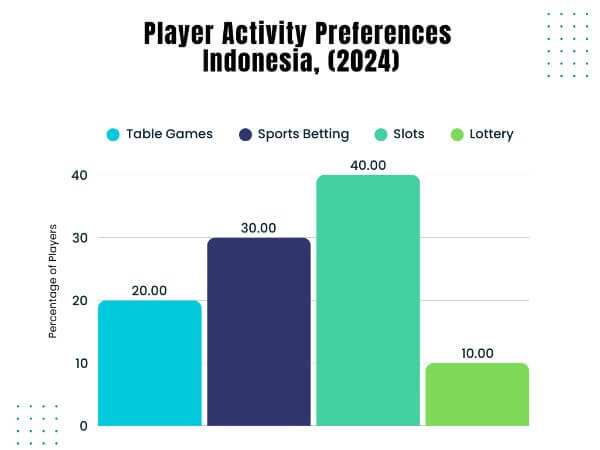

Gambling in Indonesia

In Q1 2025, over 1 million Indonesians engaged in online gambling, with 71% earning less than IDR 5 million (~$310) monthly. Since locals adore dominoes and traditional card games, local casinos in Indonesia include these activities alongside global options like poker and roulette. Domino Qiu Qiu (Poker 99), fish shooting games, and Dragon Tiger are Indonesians’ favorite ones.

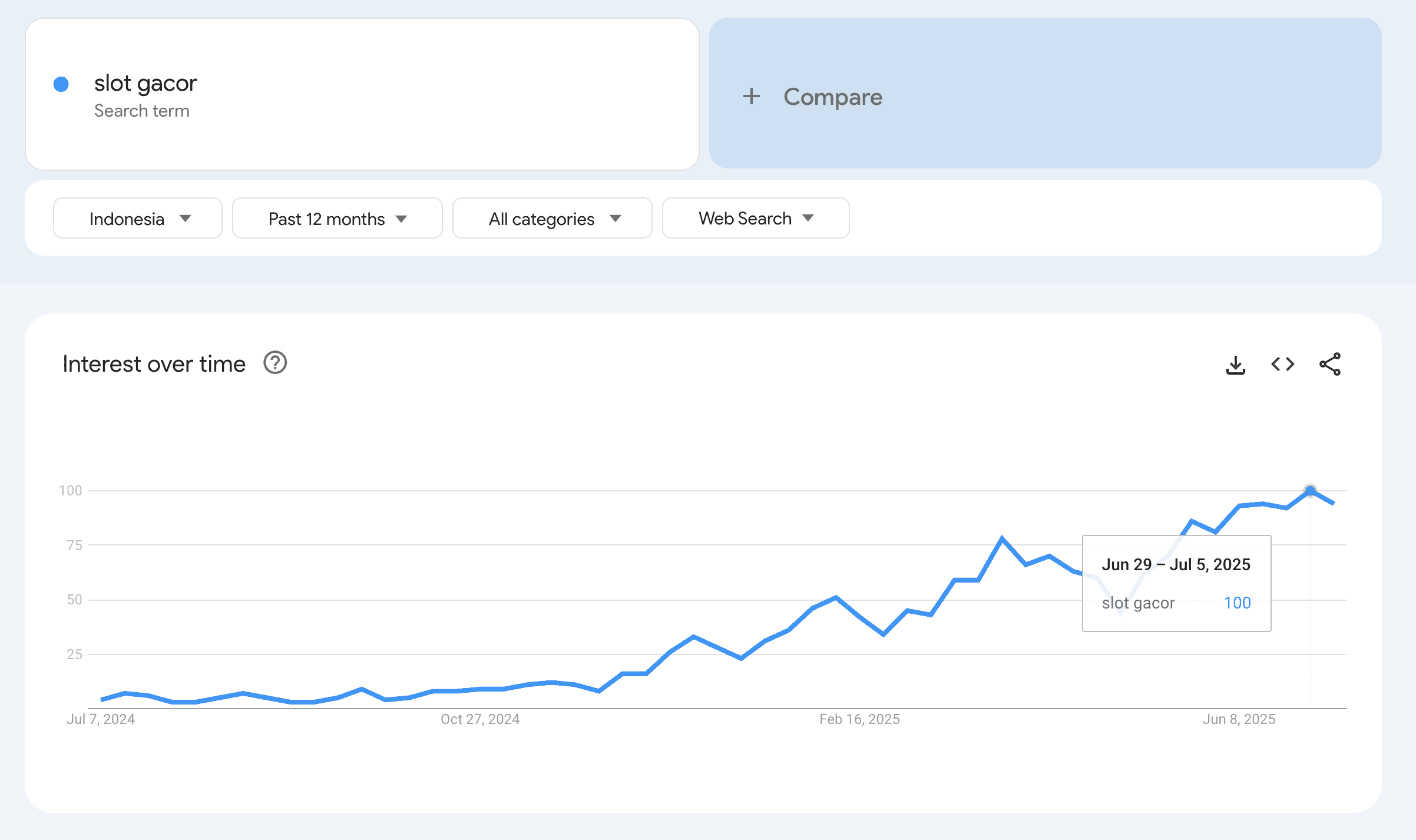

Also, searches for terms like "slot," "gacor," and "slot gacor" have surged, reflecting growing interest in online slot games:

Source: Google Trends

Note that “Gacor” is derived from the local slang, often used to describe something that is functioning exceptionally well or producing consistently positive results.

The top casinos in Indonesia are:

-

Golden Panda

-

Lucky Block

-

Mega Dice

-

CoinCasino

-

Samba Slots

-

WSM Casino

Here are the examples of creatives for gambling in Indonesia:

Betting in Indonesia

Source: igamingtoday

Though officially illegal, sports betting remains widely popular through offshore platforms that accept Indonesian players. As a rule, Indonesian sports fans use international betting sites (Bet365, SBOBET, and W88), all of which offer Indonesian language support, localized odds, and mobile-first experiences.

The most popular sports for betting offers:

-

Football. The English Premier League, Champions League, and Liga 1 Indonesia generate massive betting traffic thanks to a huge fan base and 24/7 coverage from betting sites.

-

Badminton. This is a national sport with world-class Indonesian athletes. Events like the All England Open and BWF World Tour attract intense viewer and bettor engagement.

-

Basketball. This is a fast-growing betting category, especially among younger urban audiences.

-

Esports. Tournaments in Mobile Legends, PUBG Mobile, and Dota 2 dominate Gen Z engagement, with the MPL Indonesia league being a top traffic driver for esports betting.

-

MMA / Boxing. The rise of UFC and ONE Championship in Asia has sparked strong interest in fight cards, especially those featuring regional fighters, driving high betting volume on major sporting events.

Here are the examples of creatives for betting in Indonesia:

Recommendations for advertisers

Before you start your performance marketing campaign in Indonesia, take into account the following pro tips. They will help you choose the right offers and optimize your ad creatives right off the bat.

-

The majority of internet users in Indonesia rely on Android smartphones and are highly active across social media, messaging apps, and content platforms. GEO Indonesia is especially strong for affiliate marketing specialists looking to scale traffic monetization.

-

Popunder and In-Page ads perform exceptionally well in this market, driven by high user engagement and cost-efficiency. These formats suit both betting campaigns and casino Indonesia promotions.

-

Use regional targeting: Jakarta, Surabaya, and Medan deliver the most stable traffic with high CR. Keep in mind that the audience is young, so it's best to focus on the 21–35 age group.

-

Enable frequency capping and OS targeting to prevent audience burnout.

To quickly launch and effectively scale your campaign, we recommend topping up your ad balance starting from $5000 — this will allow you to test multiple approaches, gather data, and activate automatic optimization rules directly in your EVADAV dashboard. For more precise media buying, ask your personal manager for up-to-date source whitelists: these are pre-approved traffic sources that have passed moderation and show strong conversion rates in the iGaming Indonesia vertical.

Also, mind the average bids:

-

Popunder – CPM $0,8

-

In-Page – CPC $0,01

-

Push – CPC $0,02

-

Native – CPC $0,009

How to design your offers?

Since GEO Indonesia comes with strict content guidelines, your iGaming campaigns must be localized and tactful: use entertainment-driven creatives, neutral pre-landers, and soft entry points into offers. Avoid aggressive creatives, overt "casino" references, and consider promoting sweepstakes, quiz-style games, or esports betting. Use pre-landers that frame the offer as “fun” or “skill-based”.

When creating ad creatives and landing pages, use bright colors (like gold or red) and visually emphasize the size of bonuses or the main selling point of your offer. Let the user instantly spot what makes your offer worth trying:

Whenever you’ve got questions regarding your advertising campaigns, sources of traffic in Indonesia, or the betting vertical in general, feel free to address your dedicated manager right through the EVADAV dashboard. We are always in touch and ready to help!

Payment methods

Lastly, consider payment options that are legally accepted in Indonesia. Those include electronic wallets (OVO, GoPay, DANA, ShopeePay, LinkAja, and others), bank transfers, and crypto. Note that the use of Visa and MasterCard is limited due to privacy risks.

Launch campaigns with EVADAV

Indonesia is one of the top GEOs for CPA marketing campaigns in EVADAV. We provide quality traffic from trustful sources for ultimate conversion rates, and our vast expertise will help you get maximum out of this region.

Using our intuitive dashboard, you can quickly set up targeting and get your offers approved within several minutes. In case of questions, you can contact your dedicated manager and get guidance regarding any step of your campaign creation.